“An open economy that has open governance associated with it means that anybody can be a part of this economy, anybody can be a token holder, anybody can be a storage provider, anybody can be a developer – that also means anybody can participate in economic governance. This is a unique twist to how things happen in Web3 and it presents its challenges, which I will delve into more deeply.” - Vik Kalghatgi

Kalghatgi is a research scientist at CryptoEconLab (opens new window), a global hub for cryptoeconomic research that asks the hard questions in a dynamic industry and works to find long term solutions. If you’re interested in learning more, keep an eye out for a CryptEconDay event (opens new window) in a city near you in 2023.

# Policy Changes, Economic Trade-offs and The Filecoin Network - 0:10 (opens new window)

This talk was inspired by recent economic governance phenomena that happened in the Filecoin Network. I would like to talk about the underlying issues that presented themselves on a more holistic or deeper level, not the policy change that was debated about being included in the Filecoin network, but more about how we think about economic trade-offs in general writ large in these open, decentralized permissionless blockchain spaces.

This talk is situated in the context of the Filecoin economy, in the Filecoin network, but can be generalizable to any open, permissionless blockchain network when it comes to analyzing governance or policy changes from an economic lens.

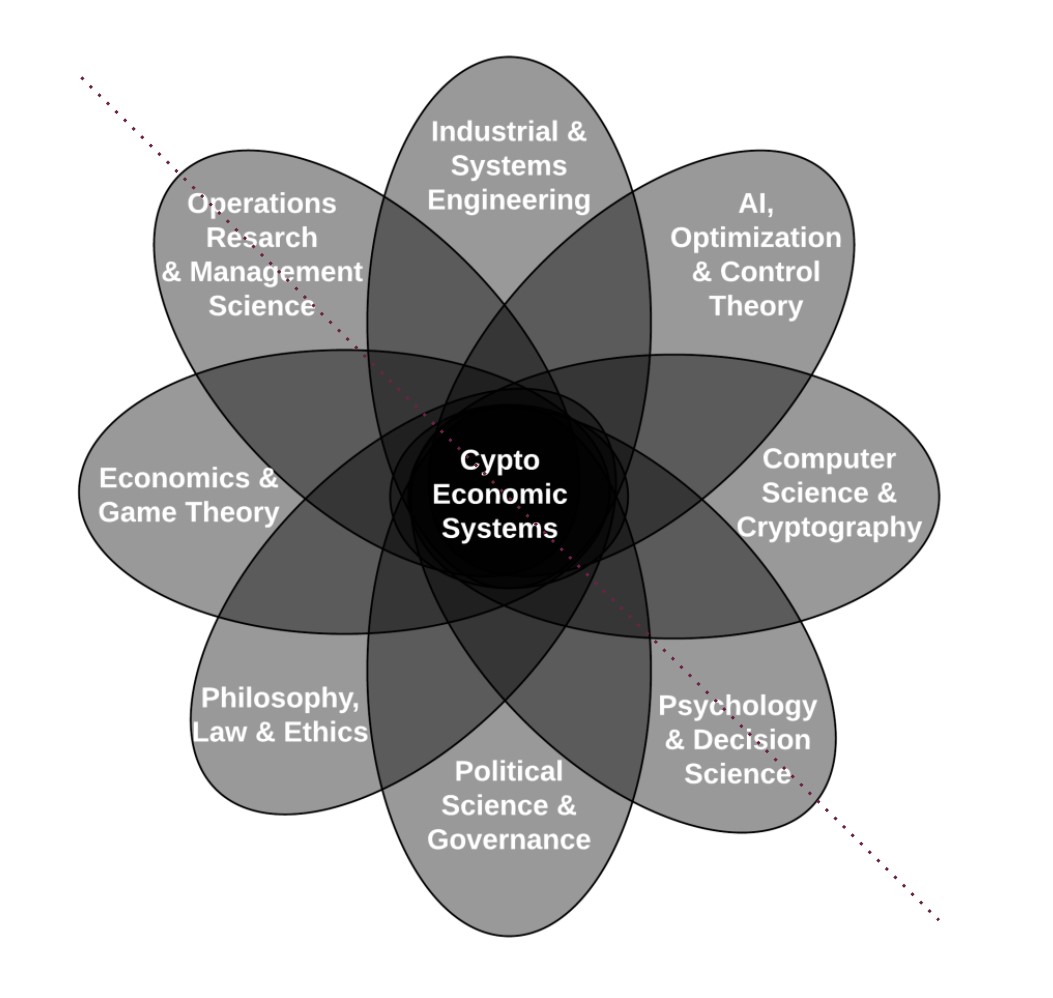

To start, I want to take a step back and talk about how cryptoeconomics and blockchain governance fit together. I think they intimately overlap. In CryptoEconLab (opens new window), we are both researchers and practitioners, and to me what that means is it matters to do research and it matters to theorize and have a vision of what our world ought to look like, or, in this smaller example, what our network or protocol ought to look like from an economic perspective. But that doesn't mean that much unless something is implemented and practiced or realized. And when you ask a question about how something can be implemented in practice, or realized, that then becomes a governance question.

This graphic illustrates all the different fields that contribute to what it means to be a crypto economist:

Let’s focus on the political science and governance part. With that in mind, let's say I want to set the stage a little bit to introduce the concept of Filecoin as this island economy.

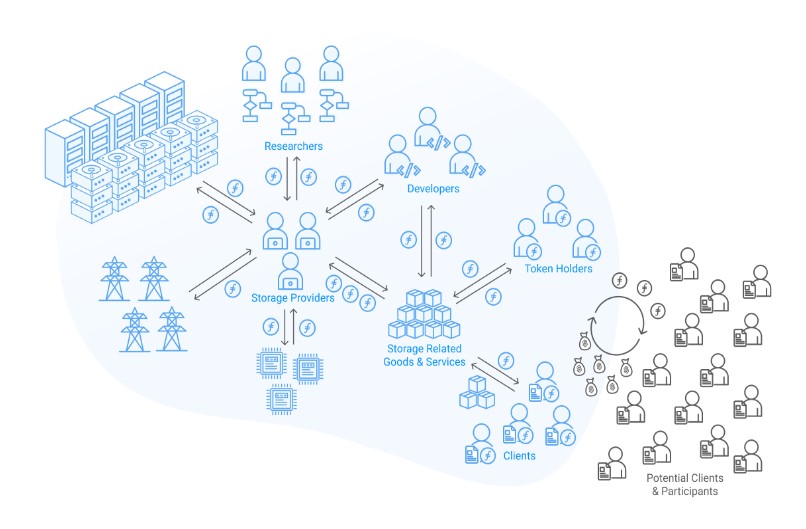

This has been done in many ways to explain the cryptoeconomics and the tokenomics of Filecoin. We can also use this to explain the governance portion, but first, let’s take a step back: what is Filecoin? At the core of it, Filecoin is an island economy that exports a certain good or goods. In my view, these are storage and storage-related services, so part of what Filecoin is exporting is raw storage capacity and archival Cold Storage capabilities, but it's also exporting the composable usage of things like compute retrieval and the modular nature of how you can combine all of these things into this truly trustless, open system or open services for data.

That is what we are doing and then the next thing is who comprises or what comprises this island economy. I think it's this diverse collection of researchers. It's token holders. Filecoin is a utility token that allows you to interact with all these different services. It is storage providers who are offering up their hardware, their resources and their time to store data. And it's developers and ecosystem partners that are building on top of the IPFS and Filecoin stack.

The way an island economy works is that it's not completely insular, in that everything that happens within the economy isn't just limited to its borders. It also touches the outside world. So Filecoin touches other cryptocurrencies. It can touch things like Ethereum, it can touch things like Solana, etc. This will become even more apparent with the launch of the Filecoin Virtual Machine. It does much more than that: it can also touch things like Web2.

If we want to be the decentralized infrastructure stack, not just for Web3 but for the world, then you can imagine this island economy touches things like gaming, content delivery and video streaming etc. – in worlds that are entirely removed from cryptocurrencies and Web3. The reason I bring this up is that also means this is an open economy that has open governance associated with it in a similar way that anybody can be a part of this economy, anybody can be a token holder, anybody can be a storage provider, anybody can be a developer – that also means anybody can participate in economic governance. This is a unique twist to how things happen in Web3 and it presents its challenges, which I will delve into more deeply.

# What Is Economic Governance and The Island Economy - 5:48 (opens new window)

When we think about economic governance, a lot of the ways we think about it is: ‘Okay, you have all of these different economic trade-offs between all these different groups.’ There are economic trade-offs – when I say trade-offs, I mean when you have an economic policy or when you have economic parameters like parameter spaces or trade-offs – what you what you're considering is economic trade-offs between certain groups, like clients, storage providers, ecosystem partners, token holders and developers.

The interesting thing about economics is that not all policies affect all groups equally and some might benefit at the expense of others. Then, what you're trying to do as an economist is balance out all the different interests of these stakeholder groups. But I think there's one more thing to add, which is the idea of the network being a stakeholder group.

What I mean by that is the protocol itself also has interests. The protocol itself also withstands the brunt or the impact of some economic trade-offs, but the interesting thing is the protocol itself is not an explicit stakeholder group and therefore it doesn't have its own voice.

The network is not just the composable, linear sum of all of the individual parts. It's much more than that. Similar to crypto, composability allows you to see the sum of the whole is greater than the sum of all of its parts.

I want to argue that the network is greater than the sum of all these individual components, because the network cares about its stakeholders now, but also it cares about all these other people that could be a part of it in the future. The network cares about its potential clients. The network should also care about who else will be contributing to this pie, because at the end of the day, if Filecoin wants to be a decentralized foundation for humanity's information, this pie needs to continue growing. We are very far from getting to that vision, so as a stakeholder, that is what the network might value much higher above, let's say, the individual interests of a specific client or storage provider or developer.

That also means that the network's voice must be very highly valued when we make economic decisions and when we look at questions of economic governance. When we go from the bottom-up model and make economic policies, and we try to balance out the viewpoints of the clients, storage providers, developers, token holders and ecosystem partners etc, that's all very good, but that is a sixth voice or sixth thing that we need to balance out as well, which is the interest of the network and the economic interests of growing this kind of pie.

The reason I think that is because this island economy that we're creating is quite literally what sustains and allows for the actions of all those individual stakeholder groups. Anyone contributing to Filecoin and building on the IPFS and building on the Filecoin stack is implicitly and greatly contributing to the island economy, but also being sustained by it. So when we look towards economic policy, if the network would speak, it should be a very loud voice. But, unfortunately it doesn't have one, so that brings me to the earlier point about how powerful this island economy is and the underlying tokenomics.

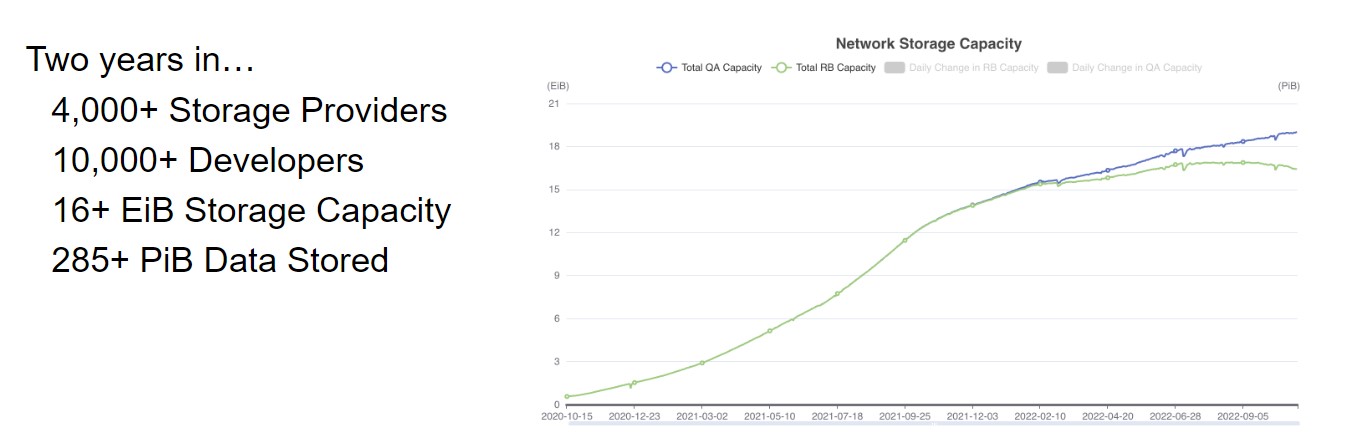

For example, at the milestone of its second birthday, Filecoin grew to become very large. We became a pretty large two-year-old.

The network is at about 16 exbibyte of committed storage capacity. That is massive – for context, it took Google or Amazon orders of magnitude of time longer to get to that same point. And then the question is: “Why did we do it so much faster?”

A lot of it is a base in economics and the tokenomics that underlie how you can create sustainable scalability and value creation via this decentralized, open network where anybody can contribute their resources. This illustrates a little bit about how the island economy sustains all of us and also how we should place a lot of credence on making sure that the island economy continues to still have the economic parameters designed to enable that value creation to continue.

I've talked a lot about how the network is this mute, omniscient voice, so then the question is: ‘Who speaks for the network and who can safeguard the network's economic interests? Some might say: ‘Is it Protocol Labs?’ or ‘Is it the Filecoin Foundation?’ Potentially, in part is CryptoEconLab the network? Is it me – am I the network? The answer to the last question is no. But, I think the answer is that when it comes to economic governance and open systems and open decentralized networks, all of us have to be prepared to await the economic interests of the network in our decision-making processes, because there is no centralized body to take on the position of being an economic safeguard. There's no federal reserve, no body that has the ability to solely care about the economic viability and the economic safety of the economy. That is a feature and not a bug of decentralized and open networks.

# Dictating economic policy in Filecoin: Meet FIPs - 15:03 (opens new window)

Should we have a Federal Reserve that dictates economic policy in Filecoin? I think that would be antithetical to a lot of the ethos of Web3, but then that also introduces its own challenges. This is the part where we talk about FIP-0036. I alluded a little bit earlier to this four month process that was very interesting in the Filecoin ecosystem, which was this improvement proposal that introduced a lot of economic changes to the Filecoin ecosystem.

For some shared context, a FIP is similar to an EIP, which is a Filecoin and it stands for a Filecoin Improvement Proposal. All FIPs introduced some kind of protocol change to the Filecoin Network and in order to be accepted, the general process involves achieving a nebulous soft-consensus approach where there's general agreement – or maybe a better term is general lack of disagreement. Then, a FIP is introduced into the protocol in network upgrades.

FIP-0036 was an economic change. I'm not really going to go into whether or not I think FIP-0036 is good or bad, or the case for or against, but I think the takeaway is FIP-0036 introduced a lot of economic trade-offs for storage providers and deal clients or people looking to store deals. It introduced trade-offs for token holders and various different ecosystem partners.

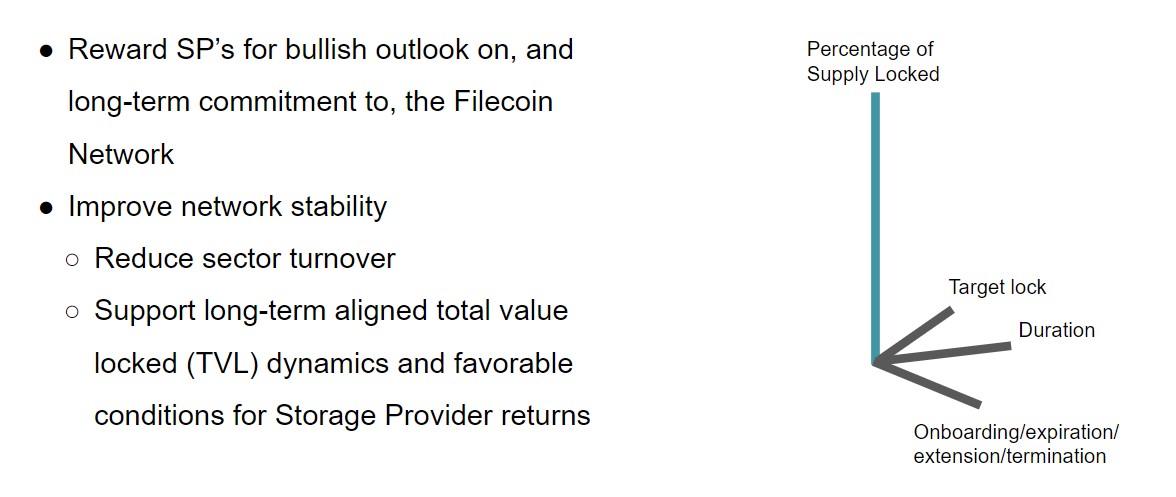

The idea is you have these different levers and a parameter that you were trying to affect with all these different levers. One of those was the percentage of supply law. This diagram isn't wholly encapsulating all of the levers and all the ambitions we have for FIP-0036, but it’s an example of it.

What inspired this talk was the idea that you have all these rational agents in Filecoin that are primarily speaking from their position of self-interest when it comes to economic policies – and that's very good. It would be hard to have cryptoeconomic systems when your agents or actors who are participating aren't rational agents, because then, how would you model a system? The base assumption in a lot of economics is that you have utility maximizing actors who are looking to maximize their expected payoff. And people did just that when it came to FIP-0036. Many people spoke from the position of: ‘How does this policy affect my expected payoff?’ And, therefore, how does that impact my perception of whether or not this is something that I would support?

I don't fault anybody for that. That makes me very happy that we have a network of rational actors. There's one more thing I'd want to add though, which is: ‘If you weight your own self-interest very importantly, but keeping in mind that we have no Federal Reserve and we have no voice for the network we all have to include at least some part of the Network's interest in our own decision-making, because if we look back, the Network, again, is what is what sustains us and allows us to continue growing this economy.

# The Future of Filecoin - 17:00 (opens new window)

I call that winning the long game. It will take a long time to get to the vision that we are trying to achieve when it comes to Filecoin. It will take many more developers and storage providers. It will take a lot more tooling and growth in retrieval markets and impact evaluators. There will be more FIP-0036 after this – this wasn't a one-off thing. There will be more cases where economic trade-offs will be hard and their rational Instinct will be to exercise your own hyper rationality and self-interest as an agent in this economy.

“If our vision is to be a decentralized economy for open services on data, then the economic health of that Network that sustains us should be a paramount consideration over time when it comes to economic policy-making.”

My one takeaway is: ’Let's think about the network, too.’ Because as we move on further and further into the future, it becomes even more important to have robust economic tooling to create economic policy for this Network to grow. The stakes only become higher as the network becomes bigger. I know we all want what's best for us and I don't blame anybody for that. I think that's perfectly natural in any system, in any decentralized Network, in which anybody can be a participant and leave whenever they want.

Thank you.