Web3 Values. As an open source company deeply committed to Web3 values: transparency, verifiability, privacy, and security are extremely important to Protocol Labs. As we head into Filecoin Liftoff Week, we want to gather some bits of information and provide them in one place. Much of this information has been communicated in other venues. Some of this information is new and described here first. We hope our leadership on these topics can influence how the community evolves over time. We encourage other participants in the Filecoin Network to publish similar information where relevant, for the benefit of the many participants in the network.

# Financial Transparency, Privacy, and Security

- Conflicting Values. PL is deeply committed to Web3 values, which include verifiability, transparency, privacy, security, and more. These values (like transparency and security) are often in conflict, and navigating them is not simple. PL takes its duties to the Filecoin community, to partners, to individuals, and to the broader Web3 ecosystem very seriously, especially in regards to these values.

- Verifiability & Transparency. Much of Web3 was born from principles around correctness and verifiability, mixing some forms of transparency and some forms of zero-knowledge verifiability. In cryptography, transparency is not the absence of privacy, but rather verifiability of important properties, so that all parties can trust computations without having to violate privacy. PL takes its duty to transparency seriously, and this is why we often communicate our actions, or try to provide some way of ensuring verifiable correctness where we cannot or should not divulge details that would violate someone’s privacy or security.

- Financial Privacy & Security. Much of Web3 was born from principles around financial security, privacy, and freedom. We live in a complex world where privacy is a form of security (opens new window). PL takes its duty to protect smaller organizations and individuals in this regard, and therefore often takes extensive measures to protect the security of others. This is why PL plans not to announce or divulge details about allocations of FIL to various groups or individuals. That said, many programs we engage in (e.g. some grant programs) will be done transparently and publicly, and those programs may divulge details at their discretion.

# The Filecoin Crypto-Economy

- Storage services, long-term. In the Filecoin Crypto-economy, miners, clients, developers, token holders, and ecosystem partners all come together to produce valuable storage-related goods and services. The economic structures are designed to reward participants for providing valuable services to the network long-term, and to balance the interests of all network participants.

- A product of many. For the past few years, many groups have been involved in the design and engineering of the Filecoin Crypto-economy: PL, mining groups, developer groups, mechanism design researchers, and more. During the last few months, and especially during the Filecoin SpaceRace (opens new window), the Filecoin Mining community has been deeply involved. Filecoin has also taken tremendous inspiration from Ethereum, Bitcoin, and many other cryptonetworks. PL & the Filecoin Community thank everyone who participated in this critical endeavor, directly and indirectly.

- Engineering Filecoin’s Economy Report. Before launch, contributors to the Filecoin Project published a paper (opens new window) laying out the cryptoeconomics of Filecoin. We imagine that many future projects will emerge to improve the Filecoin cryptoeconomy, building on that work.

- Transition to Community Governance. So far, PL has taken on most of the work and responsibility for designing the cryptoeconomy, but we have now fulfilled our duties. A big transition happened with launch. Going forward, it is now up to the community to develop the economy via community governance, rough consensus, Filecoin Improvement Proposals (opens new window) (FIPs), developer experimentation, and miners’ acceptance. PL will continue to opine and propose FIPs for community consideration, and we expect many other organizations to do so as well.

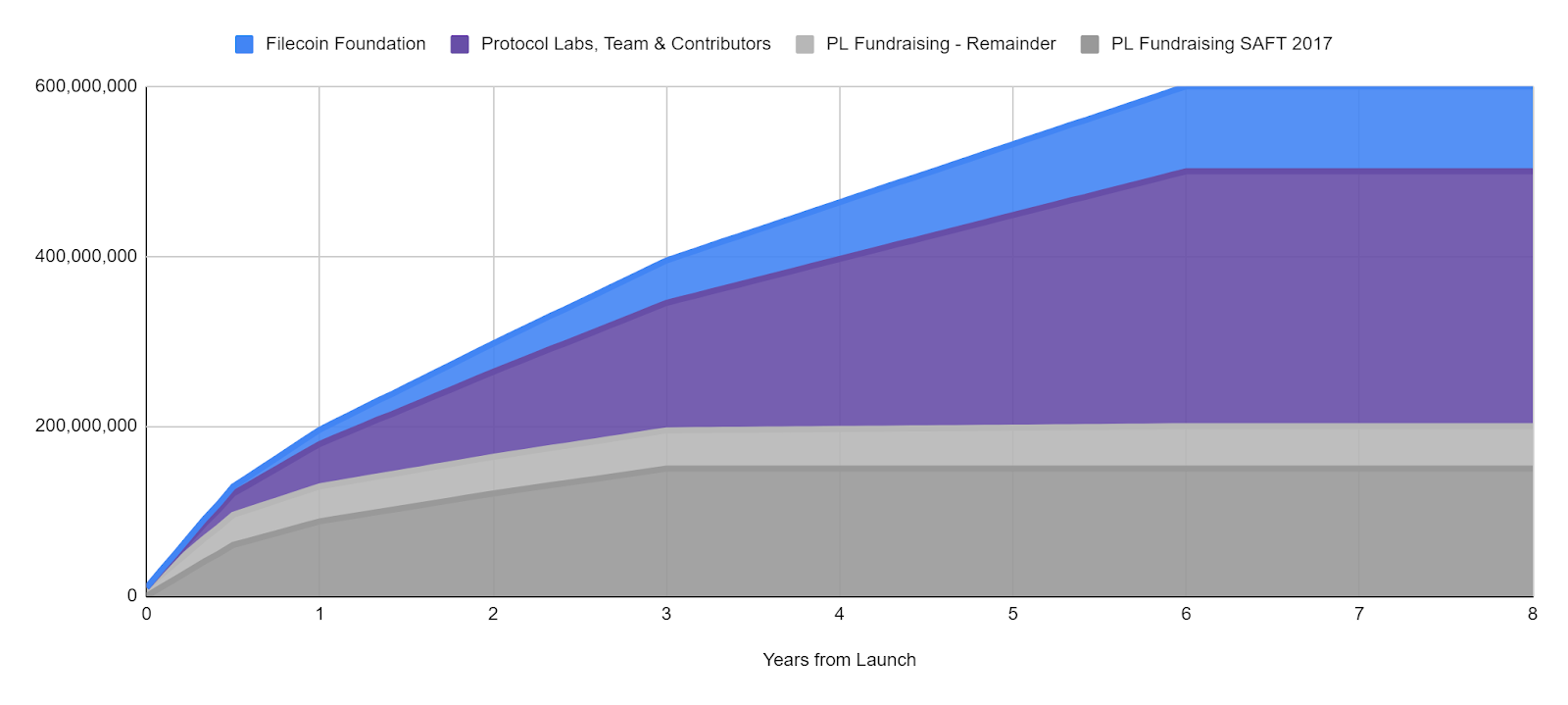

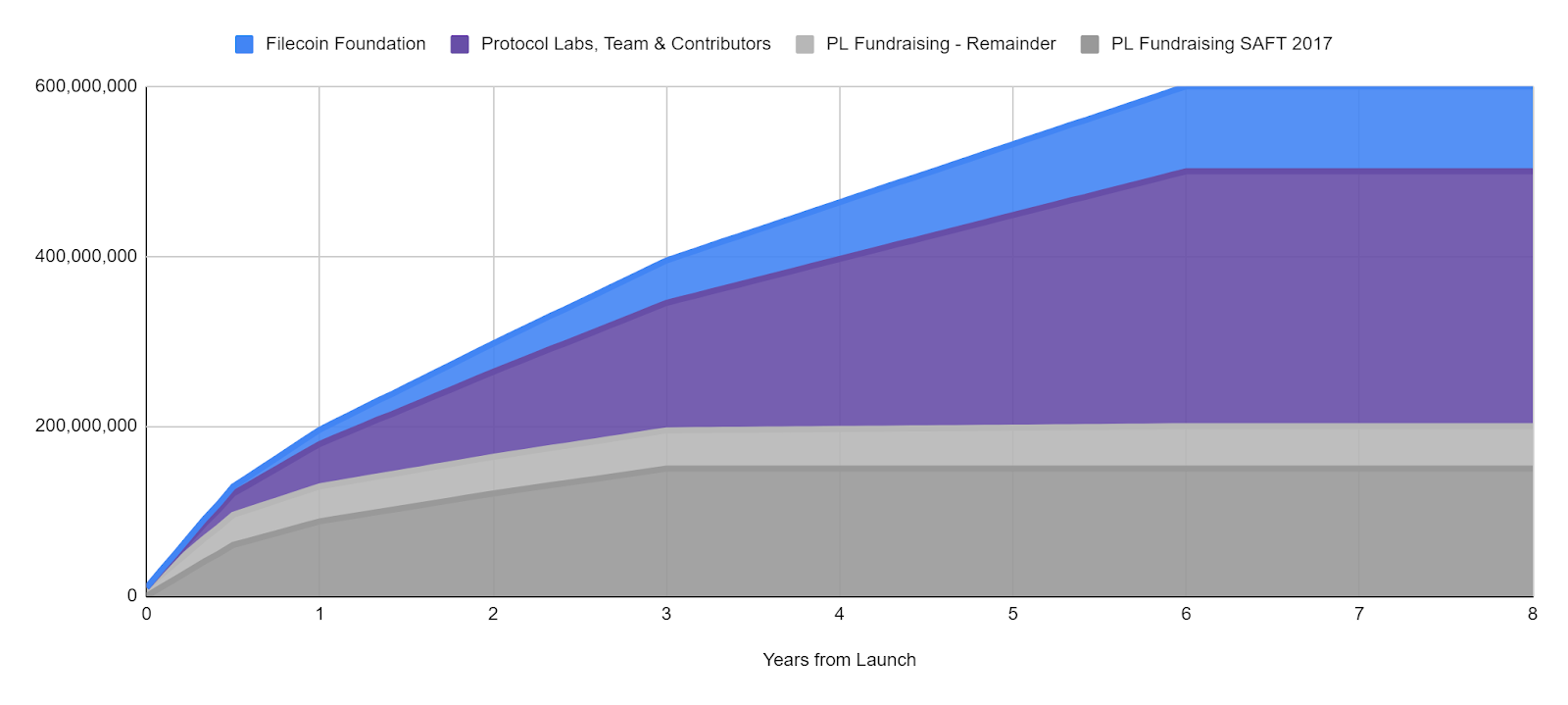

# Network Long-Term Vesting

- In order to promote long term alignment, FIL vests over a long horizon for a variety of stakeholders. Miners comprise 70% of the total 2B network allocation, with the remainder allocated and vesting as follows.

- SAFTs. All SAFT holders received their FIL subject to 6 month, 1 year, 2 year, and 3 year linear vesting terms beginning at network launch. The majority of SAFT holder FIL tokens are vesting over 3 years.

- Filecoin Foundation. The Filecoin Foundation’s 100M FIL vest linearly over 6 years, beginning at network launch.

- Protocol Labs. Protocol Labs’s 300M FIL vest linearly over 6 years, beginning at network launch.

- Much of PL’s fundraising remainder is allocated to various ecosystem supporting endeavors and other obligations. These may have different vesting schedules between 6 months and 6 years. 10M FIL has no vesting to enable market stabilization (more below).

# FIL Allocations

Protocol Labs

- PL understands the important role of its holdings for the broader community. PL has a long-term perspective on the Filecoin Network.

- To be direct, PL has no immediate plans to sell FIL. PL will be developing a plan for diversification of its FIL endowment holdings over a long horizon of many years.

- This FIL allocation includes a lot of other parties, such as grant recipients, team members, and more. Therefore, wallets associated with this allocation may or may not be controlled by PL over time. Movement in those wallets may not be related to PL.

Fundraising

- SAFTs Delivered & Terminated. Tokens for SAFT holders have been delivered to their custodians, and the SAFT contracts have terminated.

- Wallets and Custodians. A number of custodians and wallets were ready to onboard and support SAFT holders, including Coinlist, Anchorage, Gemini, Coinbase, Ledger, Glif, and some others launching soon including Metamask, TrustWallet and others.

- Remainder. PL had some tokens remaining after the token sale. These were allocated for PL’s future fundraising, ecosystem development, market stabilization, and more. In 2017, we said we may sell them in a public sale around network launch, but we chose not to do that.

Filecoin Foundation

- The Filecoin Foundation has been created and has been allocated an endowment of 100M FIL, vesting over 6 years, to help accelerate the Filecoin ecosystem.

- As originally planned, the Filecoin Foundation is a separate organization -- independent from PL -- that will work on governance, long-term sustainability, development grants, user adoption, and more in the Filecoin ecosystem.

- The Filecoin Foundation will be hosting events during Liftoff Week to highlight its team and strategy for accomplishing its mission.

# PL Team Lockup

- No sales or transfers during lockup period. Like many projects in this space, Protocol Labs has instituted a “lockup” period for tokens earned by PL’s current and former employees and contractors. Lockups are a period of time after a crypto network launches during which the token project’s team members cannot sell or exchange the tokens they have received as part of compensation from the company.

- Lockups are standard for reputable projects in the crypto network industry. Lockup periods are now standard when crypto networks launch, and signify to markets and community participants that the project’s team members are committed to the project long-term.

# Liquidity and Market Stabilization

- Long-standing Commitment. PL has said publicly before that PL would use tokens “for market stability (buying and selling filecoin on exchanges to provide market liquidity, price stabilization, correcting unbalanced incentives for storage and retrieval miners, etc.)”

- Liquidity Providers. For this purpose, PL made loans around network launch to independent liquidity providers that help to provide stability for the early hours after launch when prices are at risk of being volatile. To be clear: these are not sales of FIL from PL.

- Amount available. To achieve this, PL set aside 10M FIL. So far, we have lent 818,000 FIL to 3 liquidity providers, and have allocated upto 1M total. The loan program described below will start with 1M FIL from this same pool. The remaining 8M are unused and in reserve, in case these types of programs require more.

- Benefiting the community. These programs are primarily for the benefit of the community. In the first hours of a market, having liquidity available helps to prevent price manipulation, ensure small purchases don’t cause outsized price movements, and helps prices converge between exchanges which prevents speculative trading arbitrage opportunities.

# Pilot: Small Loans for Miners

- Collateral loans. To support miners that seek to grow their operations to contribute additional storage to the growing ecosystem, PL is going to be allocating some amount of FIL to lend to miners at market interest rates for the purposes of funding pledge collateral.

- To support miners. The purpose of these loans is to make Filecoin available to the core service providers of the Filecoin ecosystem in the weeks between launch and when markets or other participants make loans broadly available. This is not for PL to make profit. If there are profits, PL will contribute them towards grant funding to develop the ecosystem.

- Standard sizing. These loans will have standard sizes to help miners grow at what we consider to be a healthy rate. However, they will not cover the demand for high growth that many miners are undertaking now. Those miners will have to meet their collateral requirements another way, perhaps by borrowing or purchasing FIL from token holders.

- Temporal Limits. These loans will have daily limits per miner.

- Only for collateral. These loans are to be used for collateral only. If miners do not use the FIL to pay for pledge collateral, they will not be eligible for future loans. The program will be able to verify this is the case on chain.

- Administered by a third party. PL will delegate these loans to a third party provider, so that PL itself is not in the position of making the loans. Once this program is live, we will make an announcement with the chosen third party provider. FIL holders who wish to lend FIL this way should reach out to them as well

- Token holders: please provide loans & replace PL. PL invites the broader community of token holders to step up and become participants of this form in the market. PL is responding to an urgent need expressed by the community and not yet satisfied by other parties. PL hopes and expects that this pilot loan program will soon be replaced by direct transactions between FIL holders and miners, perhaps mediated through loan markets.

# Ecosystem Grants

- To date, PL has awarded approximately 4M FIL in grants to various developers, contingent on specific milestones and with the standard grant vesting over 6 years, in many waves.

- Some of our grants have been given with co-funders, like the Ethereum Foundation, the Web3 Foundation, and others.

- Other organizations (like Textile) have also provided grants to developers and others users.

- PL will continue to give grants to support various developers and communities.

- We expect that other organizations will build new and larger grant programs. We are constantly in discussions with many organizations about grant programs.

# Nov 29, 2020 Update:

# PL Team Lockup - More Details

- See PL Team Lockup description above.

- Around Dec 4th, the FIL that has been subject to a self-imposed PL Team Lockup will start being released from its lock-up restrictions linearly, unlocking over the course of about three months.

- As this lockup releases, PL will participate more actively in the network, moving and using FIL for various purposes.

# Satisfying FIL obligations

- Obligations to contributors. Many Filecoin stakeholders, including grant recipients, ecosystem participants, employees, contractors and others, have earned FIL for their important contributions building the Filecoin network over the past few years.

- Network Vesting Wallets. The vast majority of the FIL related to these obligations will be placed in linear vesting wallets, in accordance with the lockup described above and to ensure a gradual release into the ecosystem and markets.

- FIL accounted in PL allocations and vesting schedules. All of the FIL is a subset of the FIL within the PL allocations and network vesting schedule previously disclosed, and counted within the circulating supply APIs.

- Totals between 2020-December and 2021-Q1. PL will deliver approximately 25M FIL to fulfill these obligations from PL’s allocations, including PL’s fundraising remainder. See allocations described above.

- Totals between 2021-Q2, Q3, and Q4. Looking further out, PL estimates that it will deliver about 25M FIL to fulfil other current obligations.

- Transferring FIL and Wallets. This delivery will involve transferring FIL or wallets currently in PL’s control to their owners. PL will begin this delivery on or around December 1.

# Fulfilling ongoing tax needs

- Tax events. The launch of the Filecoin network, as well as the fulfillment of ongoing Filecoin obligations, create tax events which must be paid in USD or other fiat currencies and cannot be deferred.

- Fulfillment. Going forward, PL will monetize FIL gradually as required to fulfill some of these tax obligations. FIL transacted this way is accounted for within the obligations listed above.

# Fixed Token Allocations (note: not comprehensive)

- Fixed Token Allocations: The figure below outlines vesting schedules of the Filecoin Foundation, Protocol Labs Team & Contributors, the PL Fundraising SAFTs from 2017 and the PL fundraising remainder. These token allocations are known and won’t change.

- Variable Token Allocations (additive): The token minting curve is the primary driver of additive tokens to the network, but depends on many variables and cannot easily be projected. For example, to reach 550M tokens minted in 6 years, the network would need to grow to about 160 EiB (compared to ~1 EiB in November 2020).

- Variable Token Allocations (subtractive): Other elements of the network subtract to circulating supply, including tokens locked in pledge and deal collateral, burned / consumed tokens for slashing or network transaction fees, tokens locked in client storage deals, and so on.

- Important: This should not be used as a view into circulating supply, but rather it presents a summary of only the fixed token allocations noted above, and their scheduled release via the protocol.

# April 15, 2020 Update:

# Ecosystem Grants

- PL has previously noted that it will be engaging activities using FIL to directly support the Filecoin ecosystem, such as by supporting loan programs and/or making grants.

- In Q4 2020 and Q1 2021, Protocol Labs and the Filecoin Foundation have made developer grants to various teams and projects looking to build applications, tooling and infrastructure on the Filecoin network.

- The Filecoin Foundation will continue to take a leadership role in devgrants going forward.

# Supporting Filecoin Startups

- PL is helping to support organizations in the Filecoin ecosystem through programs like hackathons, accelerators, learning programs, startup competitions, and similar programs. There are a number of investment funds that are entering the Filecoin ecosystem.

- PL has and will continue to make investments in organizations that are building products, services and technology around the Filecoin ecosystem. Examples include investments through various accelerator programs (e.g. Filecoin Launchpad (opens new window) and Filecoin Frontier (opens new window)), through investment funds, and through participation in traditional fundraising rounds. These investments may be done in conjunction with other professional investment funds and/or investment funds that are dedicated to investing in the Filecoin ecosystem.

# Crypto Native by Default

- PL’s goal is to be crypto native by default.

- PL is shifting to paying for many of its expenses in crypto by default, and denominating PL’s holdings and obligations in crypto rather than fiat currency. This includes FIL, in addition to other crypto assets, to enable our partners to be active participants in the Filecoin ecosystem and to encourage others to be crypto native.

- PL previously noted that it had no immediate plans to sell FIL. However, going forward, PL may from time to time engage in a variety of transactions in FIL, other crypto assets, and fiat currency such as negotiated sales or exchanging FIL through intermediaries or partners in a gradual manner.

- PL’s FIL vests over six years beginning at network launch. PL still plans -- as previously noted -- to develop a plan for diversification of its FIL endowment holdings over a long horizon of many years.

Disclaimer: Protocol Labs undertakes no obligation to update this or any disclosures provided herein.

# 协议实验室在 Filecoin 经济中的参与

Web3 的价值观。 作为一家深深信奉 Web3 价值观的开源公司:透明性、可验证性、隐私性和安全性对协议实验室来说极为重要。当我们进入 Filecoin 主网启动周时,收集到了来自各方的不同信息,因此希望将这些信息集中起来告诉大家,其中一部分信息是最新的,我们将在这里进行首次描述,希望能在这些相关的问题上引领社区随着时间而不断发展。同时,我们也鼓励 Filecoin 网络的其他参与者也同步这些信息以帮助网络中的其他人。

# 财务透明性、隐私性和安全性

价值观的冲突。 协议实验室一直致力于 Web3 价值观的实现,其中包括可验证性、透明性、隐私性、安全性等。这些价值观(如透明性和安全性)经常会发生冲突,而平衡它们不是一件易事。在价值观方面,协议实验室非常重视自己对 Filecoin 社区、合作伙伴、个人以及更广泛的 Web3 生态的责任。

可验证性和透明性。 Web3 的大部分内容都是围绕着正确性和可验证性的原则产生的,其中包括呈一定形式存在的透明性和零知识验证性。在密码学中,透明性并不是指没有隐私,而是指其重要功能/属性的可验证性,这样各方就可以在无需打破隐私的情况下进行可信计算。协议实验室非常重视透明性,这也是为什么我们经常同大家交流我们的做法或是在当不能也不应泄露会侵犯别人隐私或安全的细节时,试图提供一些确保可验证正确性的方法。

财务隐私与安全。 Web3 的大部分内容也围绕了财务安全、隐私和自由度原则产生。我们生活在一个复杂的世界里,隐私是安全的一种形式 (opens new window)。在此,协议实验室以保护小型组织和个人隐私为己任,通过多种方案来保护他人的安全。这也是为什么协议实验室计划不对外公布或透露各个团体或个人分配 FIL 的细节。尽管如此,许多参与我们的项目(如一些开发者资助项目)将以透明、公开的方式进行,这些项目可能会酌情透露部分细节。

# Filecoin 的加密经济

长期的存储服务。 在 Filecoin 加密经济中,矿工、用户、开发者、代币持有者和生态合作伙伴都聚集在一起,生产有价值的存储相关产品和服务。Filecoin 的经济结构设计是为了奖励长期为网络提供有价值服务的参与者并平衡所有网络参与者的利益。

同心协力。 在过去的几年里,许多团队都参与了 Filecoin 加密经济的设计研发: 协议实验室、挖矿团队、开发者团队、机制设计研究人员等等。在过去的几个月里,尤其是在 Filecoin 太空竞赛 (opens new window)期间,Filecoin 挖矿社区也已经深入参与其中。同时 Filecoin 也从以太坊、比特币和许多其他加密货币中汲取了巨大灵感。协议实验室与 Filecoin 社区感谢每一位直接或间接参与这项重要工作的人。

缔造 Filecoin 经济报告。 在主网上线之前,Filecoin 项目的贡献者发表了一篇报告 (opens new window)阐述了 Filecoin 的加密经济学。我们想象,未来会有许多项目出现并会基于这项工作不断改进 Filecoin 加密经济。

向社区治理过渡。 到目前为止,协议实验室已经承担了设计加密经济机制的大部分工作和责任,现已履行了我们的职责。随着启动主网,将有一个重要的过渡。今后,会将经济的不断发展需要交由社区来进行治理、共识、Filecoin 改进提案(FIPs) (opens new window)、开发者试验以及收集矿工的接受意见。协议实验室将继续提出建议和 FIP 以供社区考虑,我们预计许多其他的组织机构也会采取同样模式参与其中。

# 网络的长期解锁

为了达成长期的激励一致性,FIL 的解锁对各利益相关者来说是一个长期的过程。其中矿工占整个 2B 网络总分配量的 70%,其余的分配和解锁如下文所述。

SAFT。 从网络启动开始,所有 SAFT 持有者收到的 FIL 均受 6 个月、1 年、2 年和 3 年线性解锁条款的限制。大多数 SAFT 持有人 FIL 代币的线性解锁期为 3 年。

Filecoin 基金会。 从网络启动开始,Filecoin 基金会的 1 亿枚 FIL 在 6 年间线性解锁。

协议实验室。 从网络启动开始,协议实验室的 3 亿枚 FIL 在 6 年间线性解锁。

协议实验室融资的大部分剩余部分将被分配到各种生态支持工作和其他义务中。这些义务可能有不同的解锁时间表,时间为 6 个月到 6 年之间。目前有 1000 万枚 FIL 无需解锁,以协助稳定市场(详见下文)。

# FIL 分配

协议实验室

协议实验室深知自己的持有份额对广大社区有深远的影响,因此协议实验室对 Filecoin 网络的发展也有长远的看法。

开门见山来讲,协议实验室没有立即出售 FIL 的计划。我们将制定一个在长期时间内(很多年)对 FIL 进行多元化配置的计划。

这笔 FIL 的分配包括很多他方,如开发者资助获得者、团队成员等等。因此,与该分配相关的保管钱包随着时间的推移可能会(也可能不会)由协议实验室控制。这些钱包的变动可能与协议实验室无关。

融资

SAFT 的交付与终止。 SAFT 持有者的代币已经交付给他们的托管方,因此 SAFT 合约已终止。

钱包和托管方。 一些托管方和钱包已经准备好加入并支持 SAFT 持有者,包括 Coinlist、Anchorage、Gemini、Coinbase、Ledger、Glif,还有一些其他即将推出的包括 Metamask、TrustWallet 等。

剩余部分。 协议实验室在代币出售后还剩余一部分,这些将被用于协议实验室未来的融资、生态开发、市场稳定等。在 2017 年时我们说可能会在网络启动前后公开出售它们,但我们现在选择不这样做。

Filecoin 基金会

Filecoin 基金会已成立并获得了 1 亿枚 FIL 的捐赠,分 6 年解锁以帮助促进 Filecoin 生态发展。

按照最初的计划,Filecoin 基金会是一个独立的组织——独立于协议实验室——将致力于 Filecoin 生态的治理、长期可持续性、开发资助、用户教育等方面。

Filecoin 基金会将在主网启动周期间举办各类活动以展现团队实力和致力于完成使命的战略。

# 协议实验室团队锁定期

- 锁定期内不得销售或转让。与该领域的许多项目一样,协议实验室对本实验室的现任和前任员工和合同方获得的代币实行“锁定”期。“锁定”是指加密网络启动后的一段时间,在此期间,代币项目的团队成员不能出售或交易他们从公司获得的作为部分报酬的代币。

- 设置锁定期是加密网络行业中信誉良好的项目的标准配置。 锁定期现在也已经成为加密网络启动时的标准配置,它向市场和社区参与者表明,项目的团队成员将长期致力于该项目。

# 流动性与市场稳定

长期承诺。 协议实验室之前曾公开表示,实验室将使用代币“用于市场稳定(指在交易所买卖 filecoin 以提供市场流动性、稳定价格、纠正存储和检索矿工激励机制的不平衡偏差等)”。

流动性提供者。 为此,协议实验室在网络启动前后向独立的流动性提供者提供借贷以帮助其在网络启动后几小时内价格有可能大幅波动时提供市场价格中立的稳定性。要注意的是:这些不是协议实验室出售的 FIL。

可用金额。 为实现这一目标,协议实验室预留了 1000 万枚 FIL。到目前为止,我们已经向 3 个流动性提供者借出了 818,000 枚 FIL,并在这方面已分配到 100 万枚 FIL。下文所述的借贷计划将从该池中的 100 万枚 FIL 开始。剩余的 800 万枚是未使用的储备金以备未来需要更多资金。

回馈社区。 此计划主要是为了回馈社区。在市场的最初几个小时里,拥有流动性有助于防止价格操纵,确保小额购买不会导致价格的过度波动,并有助于价格在各个交易所之间趋于一致,从而防止投机性套利机会。

# 试点:给矿工提供的小型借贷

抵押借贷。 为了支持那些寻求业务发展的矿工,为不断增长的生态贡献更多存储容量,协议实验室将分配一定数量的 FIL,以市场利率借给矿工,用于资助他们作为质押抵押品。

为矿工提供支持。 这些借贷的目的是在启动和推出市场期间将 Filecoin 提供给 Filecoin 生态核心服务提供商或其他参与者。这不是协议实验室盈利的方式,假如有盈利的话,协议实验室将把这些盈利作为资助贡献给生态发展。

标准大小。 这些借贷将设有标准大小以帮助矿工以我们认为健康的速度增长。但可能无法覆盖许多矿工目前正在进行的高增长需求。这些矿工将不得不以另一种方式来满足他们的抵押品要求,也许是通过向代币持有者借贷或购买 FIL。

时间性限制。 将对每个矿工设置每日借贷额度。

仅用于抵押品。 此类借贷仅用于抵押品。如果矿工没有使用 FIL 来支付质押抵押品,他们将没有资格获得未来的借贷。该计划将可以在链上进行验证此类情况的发生。

第三方管理。 协议实验室将委托第三方提供借贷,因此协议实验室本身并不负责发放借贷。一旦该计划开始实施,我们将公布所选择的第三方供应商。FIL 的持有人如果希望以这种方式借出 FIL 也可联系他们。

代币持有者。 请代替协议实验室并提供借贷。协议实验室邀请广大代币持有者群体以这种形式成为市场的参与者。我们正在响应社区表达的、尚未被满足的迫切需求。协议实验室期待这个试点借贷计划很快被 FIL 持有者和矿工之间的直接交易所取代,也或许会通过借贷市场作为中介来达成交易。

# 生态资助

截至目前,协议实验室已向不同的开发者提供了大约 400 万枚 FIL 的资助,这些资助取决于特定的里程碑,并且标准资助的解锁期限为 6 年,分多次发放。

这些开发者资助是与共同出资人一同资助的,比如 Ethereum 基金会、Web3 基金会等。

其他组织(如 Textile)也向开发者和其他用户提供了资助。

协议实验室将继续给予资助以支持各类开发者和社区。

我们期待其他团队能够创建新的、更大的资助项目,同时我们一直在与许多团体讨论资助项目。

# 2020 年 11 月 29 日更新:

# 协议实验室团队锁定期——更多细节**

- 查看以上关于协议实验室团队锁定期描述。

- 12 月 4 日左右,受到协议实验室团队自我主动锁定的 FIL 将开始在三个月左右的时间内线性解锁。

- 随着本次解锁,协议实验室将更加积极地参与到网络中并将 FIL 用于各种用途。

# 履行 FIL 义务

对贡献者的义务。 许多 Filecoin 利益相关者,包括资助获得者、生态参与者、员工、合作者和其他人员,在过去几年中为构建 Filecoin 网络做出的重要贡献并获得了 FIL。

网络解锁钱包。 与这些义务相关的绝大部分 FIL 将按照上述锁定方式放置在线性解锁的钱包中,并确保逐步释放到生态和市场中。

协议实验室分配和锁定规划表中的 FIL。 所有的 FIL 都是以前协议实验室披露的分配和锁定时间表中 FIL 的一部分,并计入流通供应 API 中。

2020 年 12 月至 2021 年第一季度的总额。 协议实验室将从协议实验室的分配中交付约 2500 万枚 FIL 以履行这些义务,包括协议实验室融资的剩余部分。见上文中分配细节。

2021 年第二季度、第三季度和第四季度的总额。 再往后看,协议实验室估测将交付约 2500 万枚 FIL 以履行其他当前义务。

FIL 转移和钱包。 此次交付将涉及将目前协议实验室控制的 FIL 或钱包转移给其所有者。协议实验室将在 12 月 1 日左右开始这项交付。

# 满足缴税需求

税务事件。 Filecoin 网络的启动以及 Filecoin 正在履行的义务,都会产生税务事件,必须以美元或其他法币支付,而且不能推迟。

履行。 今后,协议实验室将根据需要逐步将 FIL 货币化以履行其中一些缴税义务。以这种方式交易的 FIL 将在上述义务中进行核算。

# 固定的代币分配(注:不全面)

固定代币分配。 下图概述了 Filecoin 基金会、协议实验室团队&贡献者、参与协议实验室融资的 SAFT 持有者们从 2017 年开始的解锁时间表以及协议实验室融资的剩余部分。这些代币分配是已知且不会变更的。

可变的代币分配(加法)。 代币铸造曲线是网络增加代币的主要动力,但由于取决于许多变量不易预测。例如,如果要在 6 年内达到 5.5 亿枚代币的铸造量,网络需要增长到约 160 EiB(而 2020 年 11 月约为 1 EiB)。

可变的代币分配(减法)。 网络的其他因素会对流通供应量做减法,包括锁定在质押和交易抵押品中的代币、用于惩罚或网络交易费用的烧毁/消耗掉的代币、锁定在用户存储交易中的代币等。

重要的是: 这些不应该被视为流通供应量,它只呈现了上述固定代币分配的缩影以及它们通过协议预定的释放设置。

免责声明:协议实验室不承担更新此处提供的信息或任何披露的义务。