Community translations: Chinese (中文版) (opens new window), Japanese (日本語版) (opens new window) (thanks to everyone who contributed to the translations)

Impact certificates have been a recurring theme in our conference series Funding the Commons (opens new window) and Gitcoin’s Schelling Point conferences (opens new window). A few people have discussed them previously; you can find some further resources at the end of this post. Here we offer our current take on impact certificates, and on some possibilities of how, “hypercerts,” our proposed new primitive for public goods funding more generally, might be utilized.

Impact certificates are often said to enable retroactive public goods funding. Let’s start with a real-world example of why this kind of retroactive funding is useful.

# A special case of retroactive funding

Starting in February 2022, millions of refugees from Ukraine began flowing into many European cities, where people and organizations from civil society started organizing help. One of these organizations was ProjectTogether, in Berlin. They shifted resources from other projects and dedicated additional time to the newly formed Alliance4Ukraine. What is remarkable is that funders paid for this work after it already happened – ProjectTogether’s work for Alliance4Ukraine was funded retroactively.

The retroactive funding was a win-win for both ProjectTogether and the funders. ProjectTogether didn’t have to wait for grants to be approved, as it was in the lucky position to be able to reallocate existing resources to Alliance4Ukraine. But as a non-profit organization, they eventually needed to balance their cash flow. The funders benefited because they could decide how to allocate their funds without any uncertainty about the work (as it already happened) and were better able to determine the impact. Their resource allocation became more efficient.

This was, of course, an emergency situation, in which it was crucial to act fast, and in this specific case the impact evaluation process functioned to retroactively balance an existing budget – it didn’t replace the full project finance. Nevertheless, the mechanism and the benefits can be generalized more broadly to public goods funding.

# The idea behind retroactive funding

The core idea, from the perspective of an entrepreneur building public goods, is this: If you can reasonably expect to get funded retroactively for your work once you produce a positive impact, then you can work now, in expectation of a probabilistic future cash flow. In another conception, you are effectively “borrowing” money from this anticipated future cash flow to fund the work in the first place; the expectation of future funding “retro-causes” the impactful work. Retroactive funding may be able to 1) provide incentives for creators to take on public goods projects with a potentially high, but uncertain, impact and 2) create a more efficient market by back-propagating signals on what outcomes were impactful post-hoc.

In addition, creators are able to receive fair compensation by providing outsized impact that will be highly valued. It incentivizes you to create a positive impact, beyond your intrinsic motivation.[1] This doesn’t mean that the most successful creators of public goods automatically get as rich as Mark Zuckerburg or Elon Musk (or that they should), just that their potential upside does depend on how much funders value their work going forward. This will attract more talent to the public goods sector by improving performance-based compensation.

The crucial aspect for this to work: Funders need to retrospectively fund impact, and send credible signals that they will do so in the future. We will return to the question of why funders should do this below. Before that, let’s turn to hypercerts, since another necessary condition for effective use of retroactive funding is the ability to assign impact to those who created it.

# Hypercerts as a new primitive for public goods funding

Hypercerts, as introduced by David Dalrymple at Funding the Commons, (opens new window) is an interoperable data layer for impact-funding mechanisms. Each hypercert is an impact claim described by (1) the scope of work that has been (or will be) performed in a given time period by a set of specified contributors and (2) the scope of impact that this work has had (or will have) in another given time period. In addition, a hypercert has the potential to declare which rights the owner of the hypercert has, e.g. the right to publicly display the hypercert.

Individuals or organizations could create hypercerts of their work and sell all or some of them to funders, or award them commemoratively, in recognition of the funding provided. When, if or how hypercerts are sold or awarded isn’t prescribed. Hypercerts open possibilities for creators of public goods to sell or award commemoratively some prospectively and others retrospectively. Hypercerts can be sold or awarded privately to a funder or as part of a public auction. Funders can outsource the funding decision to an expert panel or to a public poll via quadratic voting. These are just a few possibilities – hypercerts are agnostic about these mechanisms, and hence facilitate experimentation with them. This is the way in which hypercerts are a new primitive for public goods funding: They define the funding objects that claim to cause positive impact and make it possible to own and transfer this impact, including in new, innovative and diverse ways. All hypercerts together comprise a data layer for public goods funding.

# Evaluation of impact claims

Individuals and organizations have the right to create hypercerts of their own work. Funders might trust these claims to be true, but in a scalable system, we believe that the claims may need to be evaluated externally. Hypercerts don’t “solve” the difficult task of impact evaluation, as it will always be specific to the area of impact. However, having a data layer of impact claims creates transparency and provides structure on the features by which impact can be evaluated – thereby simplifying the evaluation process. For instance it is easier to detect conflicting impact claims.

Since impact evaluation is a difficult task, funders might rely on other organizations that specialize in applying consistent assessment skills and methodologies to certain impact areas. Evaluators build up reputation over time similar to rating organizations in the financial sector, or appraisers or curators in the art world. This works especially well if multiple evaluators assess the same impact claims over time and disagreements on evaluations are examined in more detail.

Importantly, evaluators have incentives to differentiate their evaluations of hypercerts in a given impact market. Funders have to allocate a fixed amount of money, and they want to know where those funds have the biggest impact. A “nice” evaluator who only writes positive evaluations signals no useful information to funders; thoughtful and fair evaluators should ultimately be more trusted amongst funders. This is fundamentally different from the situation in which 100% of funding is received prospectively through grants: After such impact is created, neither the creator of a public good, nor the funders, want to hear that their efforts haven’t been effective, so frank and fair evaluation is not well incentivized in such a grant market. Retroactive funding changes this, as funders base their decisions on the information retrospectively. This makes resource allocation more efficient and enables a learning feedback loop with proper incentives.

# A dynamic environment for public goods

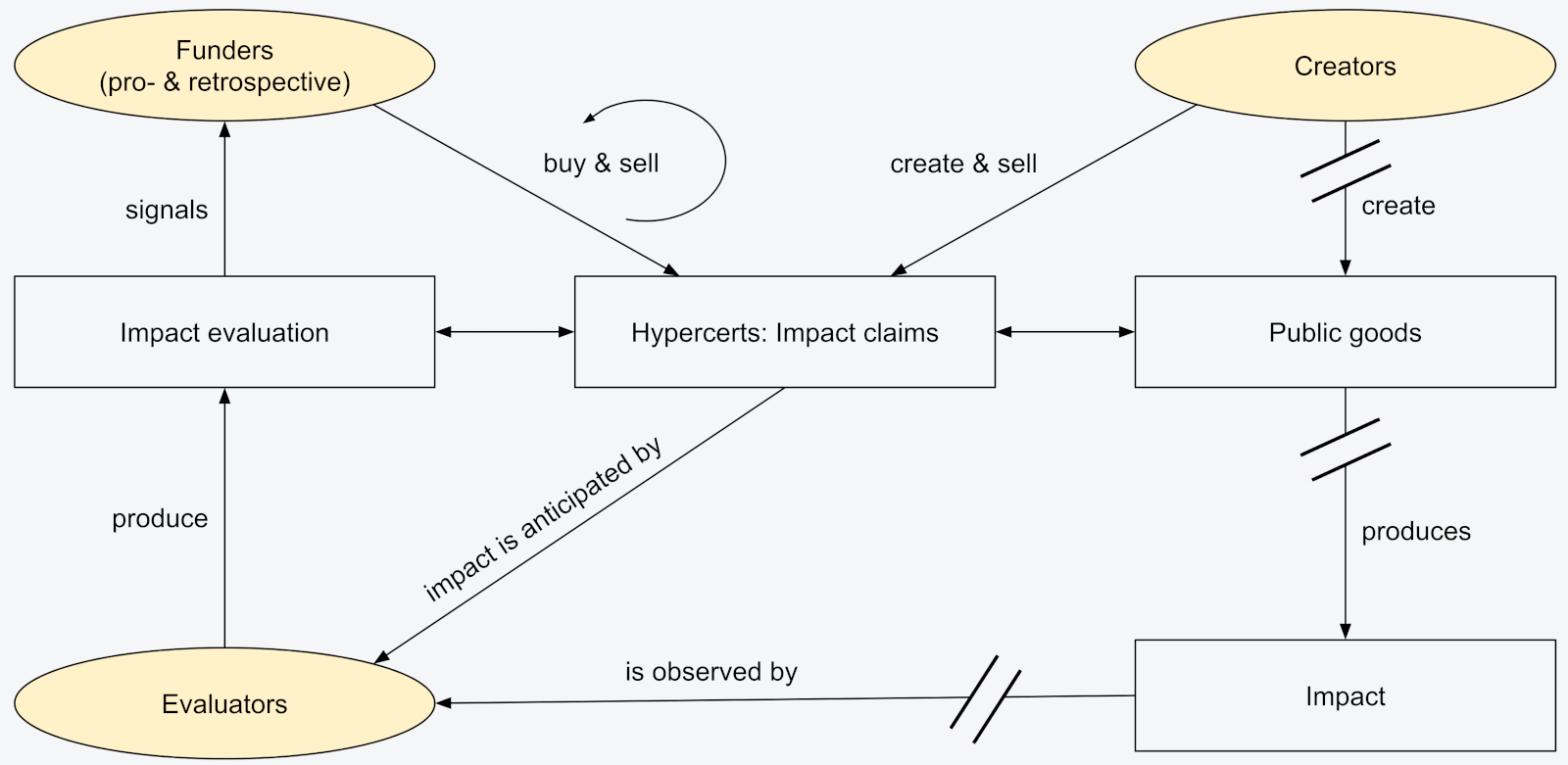

With these three main groups of actors (creators of public goods, funders and evaluators) a dynamic environment for public goods funding arises, where each group (and each individual participant) can develop and improve their skills over time for the function they perform.

The groups themselves are not homogeneous. For instance, while visionary funders prospectively provide grants to creators (analogously to current grant-makers to say, cancer research) and take on the risk that the project might fail, final transferees of impact receive hypercerts retrospectively with little uncertainty. Similarly, while some evaluators might function as scouts for visionary funders finding the best new opportunities, other evaluators specialize in retrospective audits.

The groups are split by the functions they perform, i.e. creating, funding, evaluating; however, creators who use their own funds or funders who also perform their own evaluations take on multiple roles. This is common today and may also be useful in some cases in the future. In other cases the separation will enable specialization, division of labor and optimizations of the functions. For instance, evaluators specialize in one impact area, develop a new methodology and offer this work to multiple funders. Such a dynamic system will be more efficient in the long run.

# Implementing hypercerts as NFTs to build impact markets

Many parts of this dynamic system exist already. To make it work as a whole, we can build on the dynamic NFT environment, including NFT marketplaces. Hypercerts can be implemented as NFTs, more specifically as NFTs following the ERC-1155 standard. The records could follow a standard feature set, be stored on public verifiable blockchains, and be immutable.[2] This enhances transparency and traceability, lowering transaction costs of the whole system. We could leverage the existing infrastructure around ERC-1155 as the foundation of an interoperable system, which can be used and improved by everyone.

One such improvement could be the introduction of an ERC standard specifically for hypercerts – in combination with an OpenZeppelin reference implementation. The main feature of this extension would be an operation to merge and split hypercerts along different dimensions. Splitting is useful if some funders are retrospectively interested only in some aspects of a project. Suppose a project reduces CO2 emissions and improves the health conditions in a community, but both impacts are currently contained in one hypercert. Splitting the hypercert along the dimension of scope of impact allows two different funders to show their funding of distinct elements of the project: One funds the reduction of CO2e emission, the other the improvement of health conditions. This creates incentives for creators to optimize across all public-good impact variables.

# Finally: Why funders buy impact retroactively

Now let’s return to the central question, why funders might want to buy impact retrospectively. An advantage to retrospectively buying impact is that lots of uncertainty about projects and their impact is resolved. Hence, retrospective funders can, with less effort and costs, choose more impactful projects to fund.

The motivation to do this retrospectively is based on prestige, prior commitment and/or an understanding of the effectiveness of the whole system.

- Prestige of projects: Owning hypercerts of certain projects can be very prestigious, similar to art. Think of owning parts of the impact claim of Satoshi’s bitcoin white paper or the impact claim of developing a cancer treatment.

- Prestige of aggregated variables: If the projects themselves aren’t prestigious, but their evaluated output/outcome/impact[3] can be aggregated, it can be prestigious to hold lots of those hypercerts. Think of owning impact claims of planting 10,000 additional trees or of 10,000 qualified hours of mentorship for high-school students.

- Prior commitment: Funders can today commit to buy hypercerts, e.g. a funder commits to spend $5M every 6 months for the next 10 years on hypercerts for biodiversity. They do this today to send credible signals to potential creators of public goods and, in certain implementations, to visionary funders. They follow through with this commitment in the future either because they want to stay credible, because they committed to it legally or because they committed themselves via a smart contract. This could be similar to a prize competition, but with a very different structure of commitment predicted on impact creation.

- Understanding the retroactive funding system: If funders understand the effectiveness of the whole retroactive funding system, they can start buying or receiving commemorative impact claims from the past today and announce that that is the way they will fund impact from now on. They realize that that creates credible signals to creators, which is the true impact they are having.

# Making hypercerts and impact markets a reality

We want to build the foundations for hypercerts and support 3+ impact economies in the next 12 months. If you want to contribute to these efforts, either by building the infrastructure with us, by funding through hypercerts, or by evaluating hypercerts, please reach out to us at commons@protocol.ai. Our team is also actively looking for software engineers (opens new window) and a product manager (opens new window).

# Bibliography

Overview of some previous writings on impact certificates, retrospective funding and impact markets:

- Christiano, Paul (2014) Certificates of impact, Rational Altruist, https://rationalaltruist.com/2014/11/15/certificates-of-impact/ (opens new window)

- Christiano, Paul & Katja Grace (2015) The Impact Purchase, https://impactpurchase.org/why-certificates/ (opens new window)

- Optimism & Buterin, Vitalik (2021) Retroactive Public Goods Funding, https://medium.com/ethereum-optimism/retroactive-public-goods-funding-33c9b7d00f0c (opens new window)

- Cotton-Barratt, Owen (2021), Impact Certificates and Impact Markets, Funding the Commons November 2021, https://youtu.be/ZiDV56o5M7Q (opens new window)

- Drescher, Denis (2022) Towards Impact Markets, https://forum.effectivealtruism.org/posts/7kqL4G5badqjskYQs/toward-impact-markets-1 (opens new window)

- Ofer & Cotton-Barratt, Owen (2022) Impact markets may incentivize predictably net-negative projects, https://forum.effectivealtruism.org/posts/74rz7b8fztCsKotL6 (opens new window)

- Dalrymple, David (2022) Hypercerts: on chain primitives for impact markets, Funding the Commons June 2022, https://youtu.be/2hOhOdCbBlU (opens new window)

In the design of these financial incentives, we have to be careful about crowding-out effects of intrinsic motivation. Incentives don’t just add up, but they depend on the specific context and conditions. ↩︎

The descriptions of the project could be mutable as long as the project is ongoing to include changes of the project in the hypercert. ↩︎

Sometimes the impact is difficult to aggregate, e.g. the aggregation of the effects that mentorship has on high-school students. In those cases the prestige can come from aggregating the output, such as the hours of mentorship. This isn’t perfect, but if it incentivizes the behavior we want to see, it might be good enough. ↩︎